War, inflation, and rate hikes – gold pushes higher in Q1

From: GoldSilver.com Sep-15-2024 11:16:amWar, Inflation and Rate Hikes Push Silver & Gold Higher in Q1

By Jeff Clark, Senior Analyst, GoldSilver.com

I should also point out that the persistent rise in the CPI highlights the Fed’s misstatement from a year ago..

![How Much Can You Trust Fed Proclamations?]()

And now the inflation bug-a-boo has forced the Fed to institute a new cycle of…

Interest Rate Hikes. The Fed added a quarter point to the funds rate on March 16. The debate now is how many more rate hikes the Fed will do.

While banks and analysts have various predictions, the Fed’s predicament is real. On the one hand tightening could cool inflation, but on the other hand it could hamper growth and increase the odds of stagflation or recession.

Many view the Fed as “behind the curve,” so the likelihood of further rate hikes seems inevitable. How does gold perform during rate hike cycles?![Gold During Rate Hike Cycles]()

To the surprise of many in the mainstream, gold has a tendency to rise during rate hike cycles. While it may seem counterintuitive, it’s a result of the circumstances that compel the Fed to raise rates in the first place.

I have to ask, though, how much can the Fed realistically raise rates? Debt service costs will naturally increase, which has some analysts saying the Fed will purposely remain behind the curve.

U.S. Dollar. Global events have made the dollar more vulnerable. Even Goldman Sachs has highlighted the risks to its clients, starting with the potential fallout from the sanctions on Russia. This could push some countries around the world to move away from the dollar, eroding its global dominance. They point out the dollar has similar challenges the British pound faced in the early 1900s. That Goldman released a research note on “de-dollarization” is a major sign that investors are taking those risks seriously. It also means that cross border investing will slow, maybe dramatically.

U.S. Midterm Elections. While not until early November, it goes without saying that the US is experiencing elevated levels of partisan polarization, gridlock, and radicalization. Democrats have a minor advantage in the House and a thin majority in the Senate; since some voters are frustrated with President Biden’s handling of inflation and other issues, Republicans would be in a position to block any legislative move by winning one chamber. This will likely push Democrats to make big changes before the election, including social spending and perhaps higher taxes, the latter of which could hurt equities.2022 Demands Silver and Gold Ownership

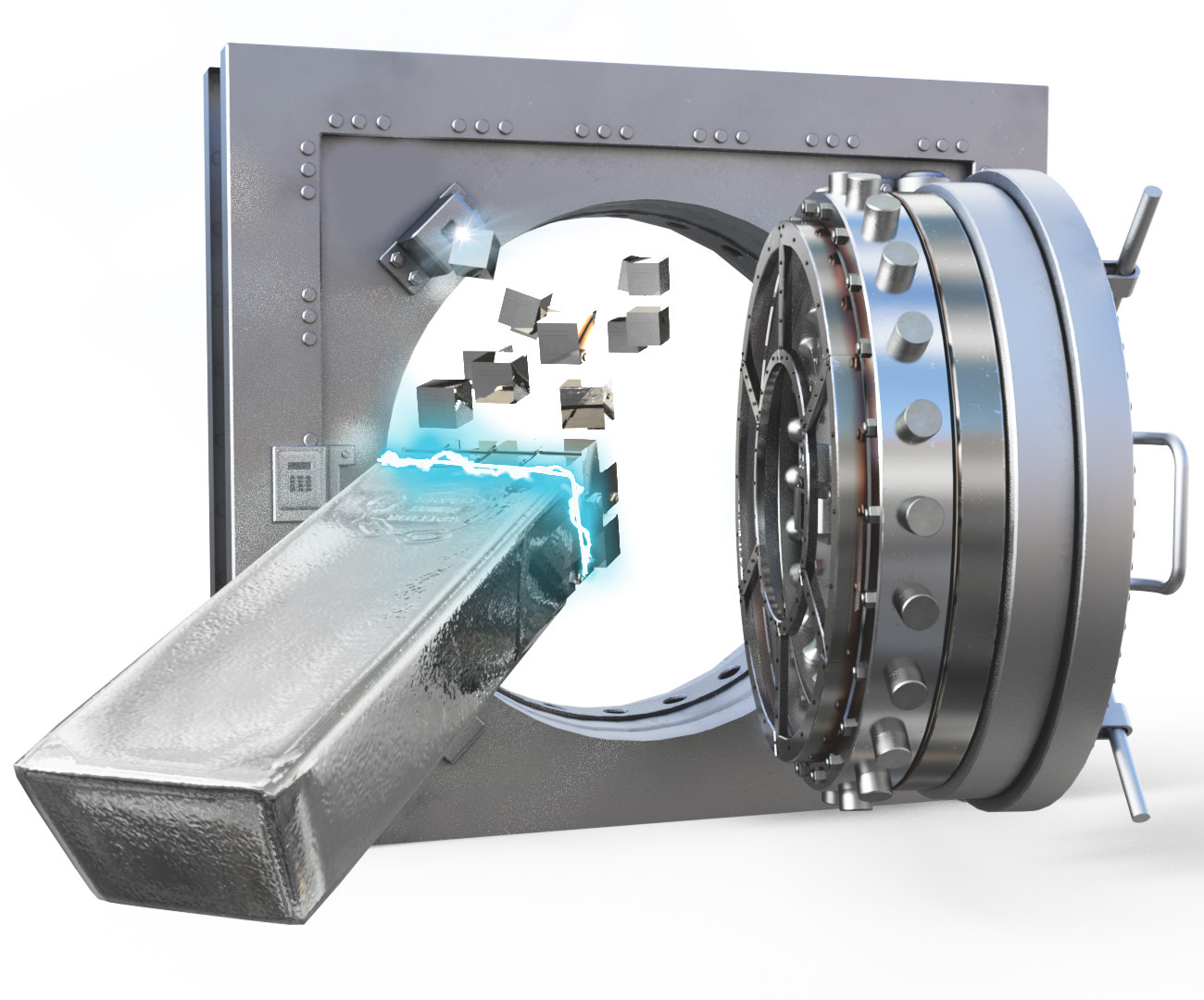

It’s hard to imagine a more ideal scenario for gold and silver…

• These challenging times have threatened the status quo, the consequences of which are hard to predict.

• Russia had $630 billion in foreign currency reserves—until the US and its allies cut them in half. The ramifications of those actions have only just begun. The adage that “money is a government liability” has been proven out.

• Record high grain prices are reminiscent of the Arab Spring, which started because of food inflation. The issues pushing food prices higher cannot be easily resolved.

• Debt and deficits remain at or above record levels. On top of that, the boost in tax revenue many advanced economies got last year from higher stock prices is absent so far in 2022.Add it all up and the need for a true safe haven asset is clear. With unresolved trends encompassing much of the globe, I expect to see the gold price reach new record highs this year.

Featured Investments

*Prices as of email send date & time.

You’re receiving this message because you’re a valued GoldSilver.com customer or you signed up to receive emails from us.

If you no longer want to receive updates on major market moves, newsletters, or occasional notifications of discounts or new products, update your preferences to choose the types of emails you want to receive or unsubscribe.

© 2022 GoldSilver LLC

750 Third Avenue, Suite 702

New York, NY 10017

1-888-319-8166

![]()

GoldSilver.com

GoldSilver.com Email Offers

- 📩 This Is HUGE. Something REALLY Important Is Happening in the Gold Market RIGHT NOW

- 📩 8 Reasons the Dollar Gets Knocked Out by Gold

- 📩 The Greatest Theft in Human History?

- 📩 📺 Banking Contagion - What Next? Plus Q&A with Mike

- 📩 Price Alert 🚨 Silver is down -4%

- 📩 Buying an RV With Gold Coins

- 📩 Price Alert: Silver is up 8.65%

- 📩 ALERT: 8 Reasons Stocks, Real Estate & Bonds Will Crater Like it's 1929 (New Book Preview)

- 📩 Super-Strong US Dollar Is De-Stabilizing All Other Fiat Currencies - When Will It End? | Gordon Long

- 📩 ALERT: The ALMOST Everything Bubble Set to Explode

- 📩 SILVER ALERT: Boring...Boring...BOOM!

- 📩 Will it really happen for silver?

- 📩 Weekly Market Recap: “Pain” Ahead As Fed Dashes Pivot Hopes While Tightening Into Recession

- 📩 Seats filling up fast – former insider reveals Fed's next moves

- 📩 A Restrictive Fed Has Changed EVERYTHING For The Markets | Sven Henrich

- 📩 Invitation to my upcoming appearance

- 📩 Weekly Market Recap: Are The Bulls Gaining The Upper Hand?

- 📩 How China Could Trigger Recession Into a Full-Blown Depression

- 📩 Decoding the Recession Double-Speak

- 📩 Silver and gold’s historical correlations to high inflation

- 📩 The 'Great Reset' IS The Death of the Global Dollar Standard

- 📩 Weekly Market Recap: Disappointing Earnings Forecast To Tank Stocks?

- 📩 Price Alert: Silver falls below $20/oz, a two-year low

- 📩 ALERT: Only 3 of 20 Rate Hikes DIDN'T End in Recession

- 📩 Gold Is Doing Its Job

- 📩 Weekly Market Recap: Sell Into This Week's Strength? Probably A Good Idea

- 📩 Mike Maloney - signs the Fed is going to break the economy

- 📩 SPECIAL REPORT: Inflation...THEN DEFLATION

- 📩 Weekly Market Recap: Will The Beatings Stop? Or Are Markets Headed Even Lower?

- 📩 Can you weather the coming Economic Hurricane? View All Email Offers >>

GoldSilver.com Promo Codes

- ⏳ Up To 3% Off 22k Gold Circle Pendant and Chai

- ⏳ Extra 5% Off 22 k Gold at Goldsilver.com

- ⏳ Up To 25% Off Select Items at Goldsilver.com

- ⏳ 10% Off Gold Bullion Jewelry. Limited to Memb

- ⏳ Deal on Store-wide at GoldSilver.com w/Coupon

- ⏳ Get $300 Off 500 Oz Sealed Mint Case American

- ⏳ Up To 5% Off Real Gold Jewelry. Members Only.

- ⏳ Extra 15% Off Store-wide w/Promo Code

- ⏳ Free US Shipping on Orders Over $499 at GoldS

- ⏳ Up To 50% Off

Popular Stores

- Prokituk.com

- Weardpc.com

- Youniverseonline

- Uk Printing Solutions

- WP101 Plugin

- Tool and Fix

- Danner

- Cryo-Cell

- Live And Learn

- Bows-N-Ties

- Boca Bearing

- Bobbitoads.com

- DK Custom Products

- French Bull

- Forever Bamboo

- Frou Frou Collection

- Dinn Bros. Trophies

- Filthy Fragrance

- Edensrx.com

- Diamond Tour Golf

- DiscountCoffee.com

- Dry Case

- Totallytickets.com

- Spa de Soleil Laboratories

- Puredetroit.com

- Thecrystalden.com

- Polish Boutique

- Fone Gear

- Papergardenrecords.com

- Solespikes.com